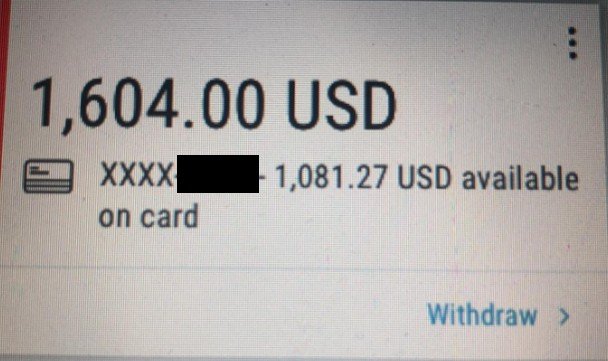

Replace 1: If there’s a distinction between your “out there stability on card” and whole stability in payoneer, then you need to use non out there stability on card, for instance your whole stability is $1000 in Payoneer USD stability and $200 is exhibiting as “out there stability on card” then you’ll be able to withdraw and use remainder of $800, because it’s in your Payoneer account not in your card.

Payoneer customers have reported that they’re getting error whereas doing transactions of their Payoneer accounts. It is because Payoneer has despatched this e-mail stating:

As you will have seen on the information, Wirecard AG filed for insolvency on Thursday. Your Payoneer Pay as you go Mastercard® Card is issued by its subsidiary, Wirecard Card Options Restricted (WCSL) within the UK. As we speak, the Monetary Conduct Authority (FCA) which regulates WCSL, issued necessities on WCSL, freezing all pay as you go card exercise in the intervening time. We imagine that cardholder funds are correctly safeguarded and that the freeze will likely be momentary.

What does this imply?

The FCA has communicated that they’ve taken these measures with the first goal of defending the pursuits and cash of Wirecard prospects. Pending additional actions from the FCA, you’ll briefly be unable to withdraw the funds in your card, nor obtain new funds onto your card.

Any funds which can be in extra of the utmost stability of your card are held by Payoneer and are subsequently not impacted by the FCA’s momentary freeze.

How can I receives a commission throughout this time?

Any future funds that you simply obtain from marketplaces, platforms and purchasers won’t be affected by the freeze. You’ll be able to check in to view your funds, and now you can add your checking account for withdrawal of your future incoming funds.

We’re actively engaged on providing further choices for you and your endurance and understanding are extremely appreciated. We apologize for any inconvenience this will likely trigger and we’ll replace you with extra info as quickly as we have now it.

Thanks,

The Payoneer Crew

It means Payoneer card holders wouldn’t have the ability to withdraw to native financial institution, do cash transfers and anything, if they’ve a Payoneer card issued for his or her account stability.

When somebody creates a Payoneer account, Payoneer affords him/her a Mastercard that can be utilized On-line and you may also withdraw cash utilizing ATM. In case you’ve such card issued beforehand then you wouldn’t have the ability to do any transaction as a result of that card is issued by Wirecard AG’s subsidiary and at the moment there’s a momentary maintain on all actions linked to that card/account.

What’s subsequent?

In keeping with e-mail issued by Payoneer together with Tweets, it looks as if Payoneer is assured about the issue and it’ll be solved quickly. Right here’s the Tweet from Payoneer:

We all know there are considerations in regards to the Wirecard information and the way it impacts Payoneer playing cards. Relaxation assured, Payoneer is robust, steady, and dealing to maintain your funds protected. Extra particulars right here: https://t.co/My1JgbSZtb

— Payoneer (@Payoneer) June 27, 2020